Do you really understand all your insurance palns...

+3

vishwas.tp

enidhi

gbhupesh

7 posters

Page 1 of 1

Do you really understand all your insurance palns...

Do you really understand all your insurance palns...

Do you really understand all your insurance palns ..............................

What is the insurance value of the policy?

Have you read plan document your self or just know what your agent told you?

Did your agent told or you asked him or do you know how much your

insurance agent will get as commission in first, second, third and

subssequent years?

Did you bought it for investment or for insurance .. ?

Do you know how much it will cost you to get same coverage Term Plan Policy?

What is the insurance value of the policy?

Have you read plan document your self or just know what your agent told you?

Did your agent told or you asked him or do you know how much your

insurance agent will get as commission in first, second, third and

subssequent years?

Did you bought it for investment or for insurance .. ?

Do you know how much it will cost you to get same coverage Term Plan Policy?

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

Well, I generally decide the policy after reading about it in company website and tell the agent (in most cases relatives)...

I know how much commission they earn, because I myself have attended 100 hours IRDA training...

By and large I buy for investmetn

I know how much commission they earn, because I myself have attended 100 hours IRDA training...

By and large I buy for investmetn

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

While buying

I didn't go through policy terms and conditions in detail but dealt it at a

very high level. Policy was a tried and tested policy, was suggested by many of

my relatives and it made some sense to me also.... So bought it...

When I

bought life coverage I had very little knowledge of financial products, so

thought it as an investment but later realized that it should be used as only

life coverage and not as an investment. With this booming Mutual fund market...

if we invest the same amount for the same term in a good mutual fund, we will

have more money than what we would get from a LIC plan.

So lessons learnt:

-----------------

Investement

1. ULIPS are better for long term as we will get chance to switch between three four

funds depending on the market situation.

2. Invest in a mutual fund (discipline is required).

Life coverage:

--------------

1. Endowment plan: If ready to pay for example 5 lakh over a period of 20 years

and expect around 10 Lakh at the end (based on bonuses accumulated)

2. Term plan: Pay light and get high coverage. Will never get your paid money back, but

premium will be very less...

I didn't go through policy terms and conditions in detail but dealt it at a

very high level. Policy was a tried and tested policy, was suggested by many of

my relatives and it made some sense to me also.... So bought it...

When I

bought life coverage I had very little knowledge of financial products, so

thought it as an investment but later realized that it should be used as only

life coverage and not as an investment. With this booming Mutual fund market...

if we invest the same amount for the same term in a good mutual fund, we will

have more money than what we would get from a LIC plan.

So lessons learnt:

-----------------

Investement

1. ULIPS are better for long term as we will get chance to switch between three four

funds depending on the market situation.

2. Invest in a mutual fund (discipline is required).

Life coverage:

--------------

1. Endowment plan: If ready to pay for example 5 lakh over a period of 20 years

and expect around 10 Lakh at the end (based on bonuses accumulated)

2. Term plan: Pay light and get high coverage. Will never get your paid money back, but

premium will be very less...

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

> I know how much commission they earn, because I myself have attended 100 hours IRDA training...

IRDA rules says, every insurance agent should inform client about his commission on the product (not sure only if asked about it ).

> Policy was a tried and tested policy, was suggested by many of my relatives and it made some sense to me also.... So bought it...

Are common people really work to calculate the return on the policy? Most of the time marketing material do make sense (though on paper), but in reality they may be quite far from the target.

>ULIPS are better for long term as we will get chance to switch between three four funds depending on the market situation.

As long as longterm capital gain tax is nill on equity investment, does it really make sense to invest in ULIP? ( MF entry load [NIL] vs ULIP [agent commission + admin fee, + etc .. + etc ] ) Market has corrected 30% since Jan 21 Level. When a ULIP policy holder sould/ shouldl have really switch/ed his units? How many will do that when time come?

---------------------------------

I feel a person who is not paying income tax or in just 10% limit should not buy insurance policy for investment. Should only buy Term Plan.

IRDA rules says, every insurance agent should inform client about his commission on the product (not sure only if asked about it ).

> Policy was a tried and tested policy, was suggested by many of my relatives and it made some sense to me also.... So bought it...

Are common people really work to calculate the return on the policy? Most of the time marketing material do make sense (though on paper), but in reality they may be quite far from the target.

>ULIPS are better for long term as we will get chance to switch between three four funds depending on the market situation.

As long as longterm capital gain tax is nill on equity investment, does it really make sense to invest in ULIP? ( MF entry load [NIL] vs ULIP [agent commission + admin fee, + etc .. + etc ] ) Market has corrected 30% since Jan 21 Level. When a ULIP policy holder sould/ shouldl have really switch/ed his units? How many will do that when time come?

---------------------------------

I feel a person who is not paying income tax or in just 10% limit should not buy insurance policy for investment. Should only buy Term Plan.

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

Bhupesh,

I read some where that, IRDA head C.S. RAO stressing on increasing Term plan customer base and people to treat insurance just as a security for the dependents and not as an investment.

Read this article(http://www.indianexpress.com/story/296337.html) from Indian express... where IRDA is taking initiative to promote Term plans...

I read some where that, IRDA head C.S. RAO stressing on increasing Term plan customer base and people to treat insurance just as a security for the dependents and not as an investment.

Read this article(http://www.indianexpress.com/story/296337.html) from Indian express... where IRDA is taking initiative to promote Term plans...

IRDA should do "Jago Grahak jago" campaign

IRDA should do "Jago Grahak jago" campaign

This is very positive thinking; I think educating customer will take care of half of the problem, why not we advertise on TV just like "Jago Grahak jago" campaign.

India has huge unemployment and under employment. So lot of people gets attracted towards selling insurance, many people are selling few policies year. I do not think as of now an insurance agent work to match the amount he gets as commission. I think in addition to removing cap on commission for Term Plan products IRDA should try to limit commission of other product so that selling proposition improve from both the sides.

India has huge unemployment and under employment. So lot of people gets attracted towards selling insurance, many people are selling few policies year. I do not think as of now an insurance agent work to match the amount he gets as commission. I think in addition to removing cap on commission for Term Plan products IRDA should try to limit commission of other product so that selling proposition improve from both the sides.

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

Most people know that first year commission will be around 20-30%, second year-5-10% (depending on company, policy etc)...

Some customers insist that agent pay first 2-3 months premium..

Some customers insist that agent pay first 2-3 months premium..

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

many people are selling few policies year-I think most companies have minimum target of 12 policies an year..

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

yes, it comes to one policy a month, too may agent in a city, undercutting on commision. It can not give a decent living for a family. For most of the agent it is a side business.

In Bangalore getting commision back from an agent is difficult, specially for an IT employee. Giving commision back to customer is against code of conduct for an agents but in other cities it is very common. Why not rationalise it and bring down commision?

Bring more professionlism to agent business. I am not sure what they teach in those 100 hr. Is it just how to read tables? I think any one selling insurance should have done a special one year diploma course.

I think any one selling insurance should have done a special one year diploma course.

In Bangalore getting commision back from an agent is difficult, specially for an IT employee. Giving commision back to customer is against code of conduct for an agents but in other cities it is very common. Why not rationalise it and bring down commision?

Bring more professionlism to agent business. I am not sure what they teach in those 100 hr. Is it just how to read tables?

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

Also why not companies give me a discount of 25% on first year premium of I buy a policy direct on their website without going through an agent?

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

yes, when sebi made no entry load rule for direct application to Mutual Fund house. People raised question, there may come similar demand for insurance policies.

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

But that would also make life difficult for insurance agents- One would take advice from them- which one to buy and then go and buy from the company directly, saving on commission...

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

Good article..

ashwini- MoneyTalker

-

Number of posts : 26

Number of posts : 26

Age : 41

Location : Udupi

Registration date : 2008-02-02

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

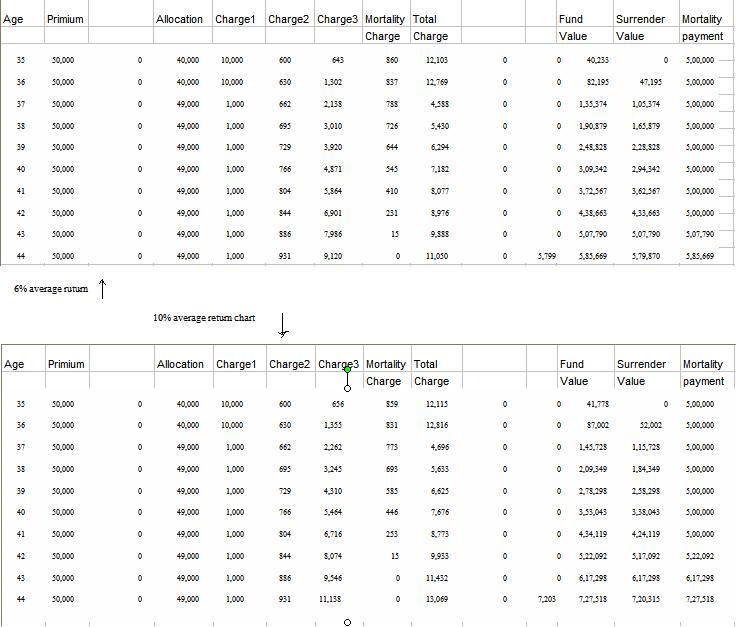

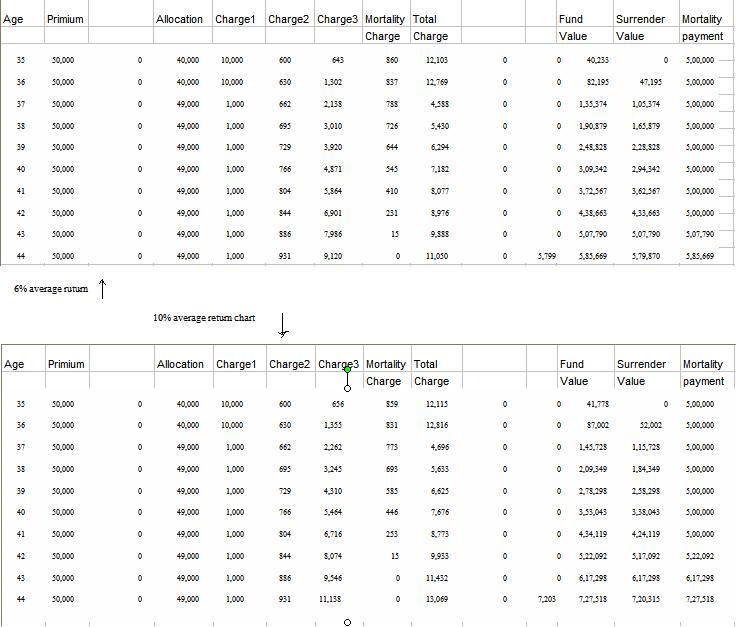

Look this chart based on 6% and 10% average return calculation for a Unit link policy.

Compare it with simple 10% FD/MF investing ..

Compare it with simple 10% FD/MF investing ..

| Premium | Allocation | Term Plan | |||

| premium | Investment Value | Mortality Value | Ulip Value | ||

| 50000 | 48600 | 1400 | 53460 | 553460 | 41778 |

| 50000 | 48600 | 1400 | 112,266 | 612,266 | 87002 |

| 50000 | 48600 | 1400 | 176,953 | 676,953 | 145728 |

| 50000 | 48600 | 1400 | 248,108 | 748,108 | 209349 |

| 50000 | 48600 | 1400 | 326,379 | 826,379 | 278298 |

| 50000 | 48600 | 1400 | 412,477 | 912,477 | 353043 |

| 50000 | 48600 | 1400 | 507,184 | 1,007,184 | 434119 |

| 50000 | 50000 | 0 | 612,903 | 612,903 | 522092 |

| 50000 | 50000 | 0 | 729,193 | 729,193 | 617298 |

| 50000 | 50000 | 0 | 857,112 | 857,112 | 727518 |

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

but a part of ULIP goes towards risk coverage...

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

That is already included in above chart see "Mortality charge" column.

Similierly I have subtracted 1400 per year for 5 lakh Term plan cover from my calculation of FD/MF return.

Similierly I have subtracted 1400 per year for 5 lakh Term plan cover from my calculation of FD/MF return.

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

Good article and I really liked the chart that has been displayed here... As investors , we should all be very conscious of where we put in our money.

anushgill- MoneyTalker

- Number of posts : 11

Registration date : 2010-05-10

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

hello everyone..

Thank you for sharing information..

regards,

phe9oxis,

http://www.guidebuddha.com

Thank you for sharing information..

regards,

phe9oxis,

http://www.guidebuddha.com

srujanaa4- MoneyTalker

- Number of posts : 60

Registration date : 2010-08-04

Re: Do you really understand all your insurance palns...

Re: Do you really understand all your insurance palns...

hello everyone

Thanku for sharing the information..

regards,

phe9oxis,

http://www.guidebuddha.com

Thanku for sharing the information..

regards,

phe9oxis,

http://www.guidebuddha.com

sru123- MoneyTalker

- Number of posts : 54

Registration date : 2010-08-07

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum|

|

|

Atom Feed

Atom Feed